Characteristics in SAP CO-PA & How to maintain Characteristics?

In this blogpost we will see the use cases of characteristics in SAP COPA. It is essential to understand the importance of characteristics because this is a first building block of Profitability Analysis.

If you are setting up profitability analysis, then as initial steps you have to sit down with client to point out required characteristics based on which profitability reports will be extracted.

Characteristics are also important from database point of view, as the number of characteristics impacts the size and complexity of data.

Before we get into more details, as disclaimer this blogpost is a piece of eBook – Controlling Profitability Analysis in SAP. If you want to learn end to end SAP COPA then you can checkout this book, which talks about everything from start to end in simple & plain English.

What are the characteristics?

Characteristics are nothing but those aspects on which we want to break down the profit logically such as a customer, region, product, sales person etc.

Several essential and obvious characteristics are pre-defined automatically for every operating concern; these are known as fixed characteristics.

In addition to fixed characteristics, up to 50 non-fixed characteristics can be added to an operating concern.

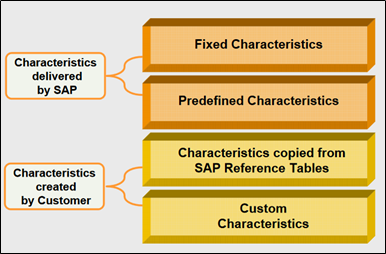

Characteristics can be categorised in four types:

- Fixed characteristics: Some characteristics are automatically pre-defined in every operating concern.

- Pre-defined characteristics: In addition to fixed characteristics, a number of other pre-defined characteristics are available in the field catalogue and can be added to operating concern.

- Copying characteristics from reference table: You can create characteristics by coping from table.

- Characteristics created from scratch: You can create characteristics, by defining own logic to derive values.

To derive values of these characteristics, it is necessary to create derivation rules or table lookup rules unless they are readily available in the sender application (For e.g. in SD data flow to CO-PA, fields on the billing document).

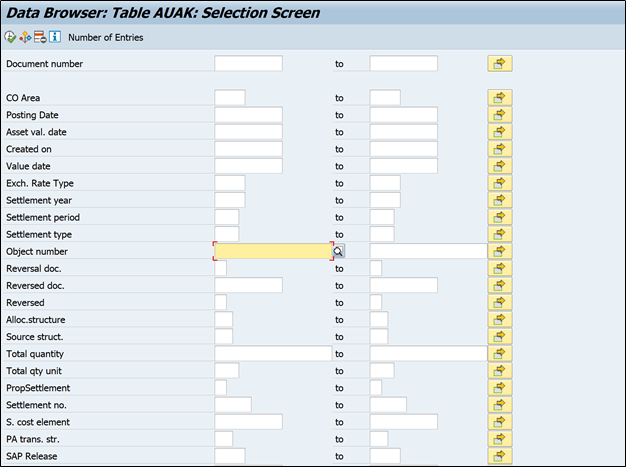

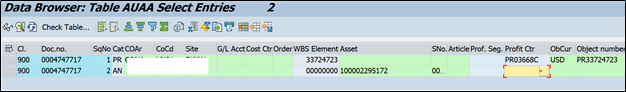

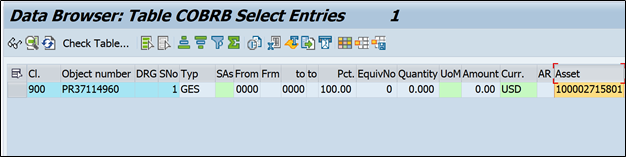

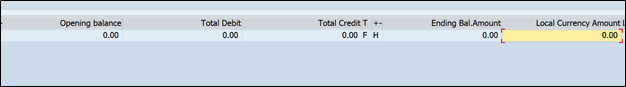

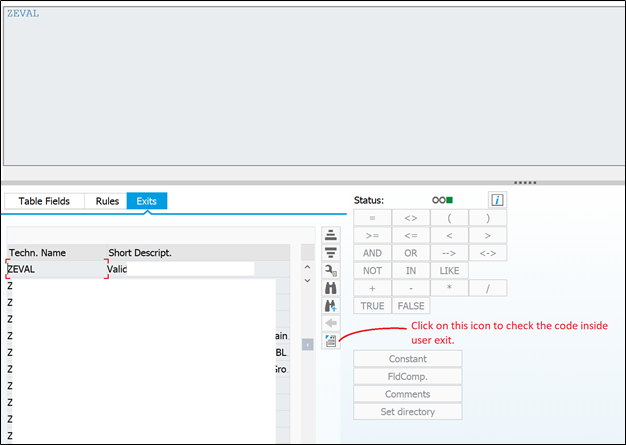

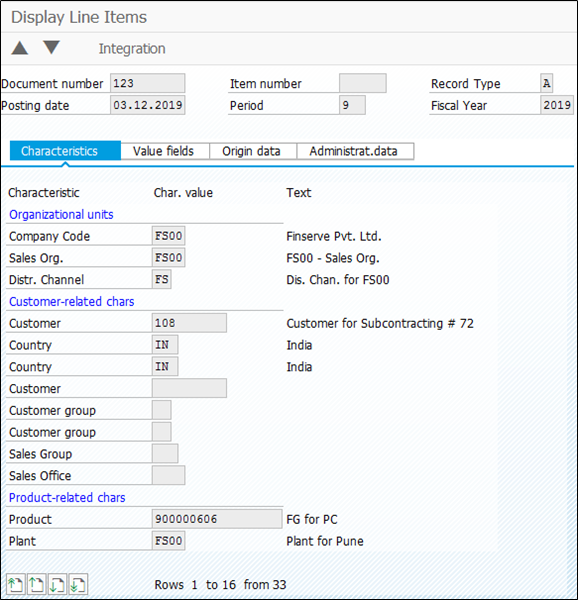

When a value flows from SD, MM, CO, and FI to CO-PA, it will create a line item in the CO-PA tables. The way you customize the master data will directly impact how the characteristics and value fields are populated in the line items. Below is one example of a CO-PA line item.

You can see that the characteristics were populated automatically by the system in above snapshot. You can change the behaviour of the assignments and also complete the missing ones. It’s very important to have all characteristics filled for each posting so that the CO-PA reports you run for any characteristic are complete.

Characteristics derivation makes it possible for the system to automatically derive unknown characteristics value (especially for user defined characteristics) if these are dependent on characteristics whose values are known.

Also read: Everything about derivation rule in SAP Controlling Profitability Analysis

Also

Maintain Characteristics

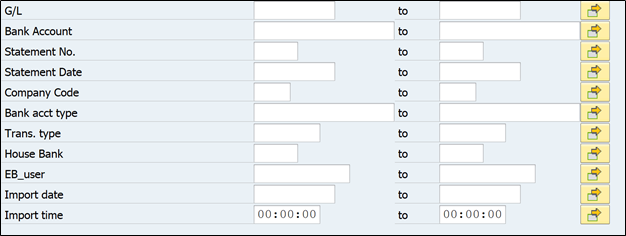

Access the activity using the following navigation options:

| SAP Easy Access | Controlling -> Profitability Analysis -> Structures -> Define Operating Concern -> Maintain characteristics |

| Transaction code | KEA5 |

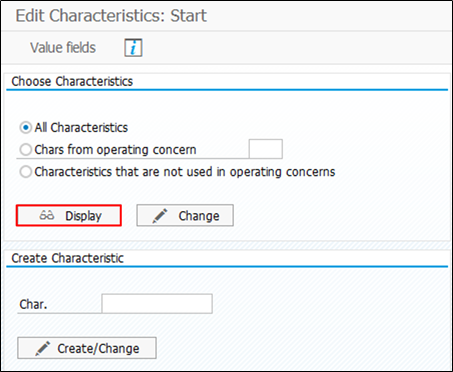

Click on display.

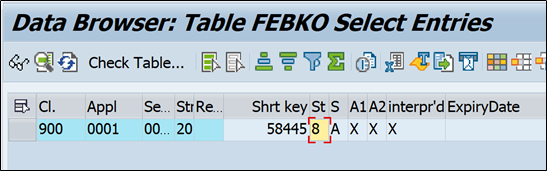

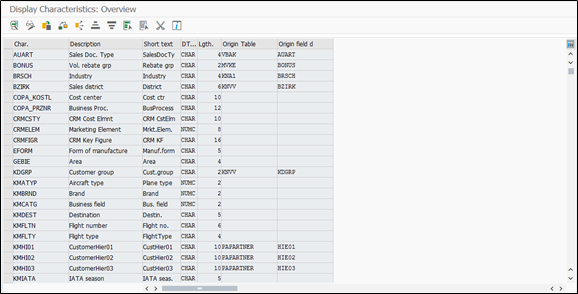

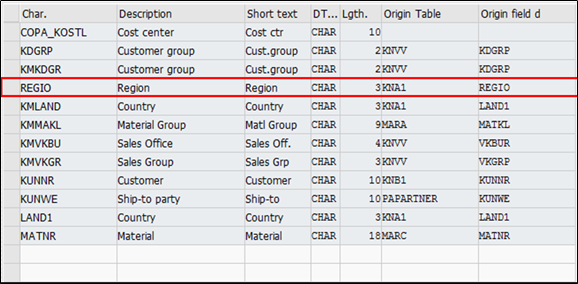

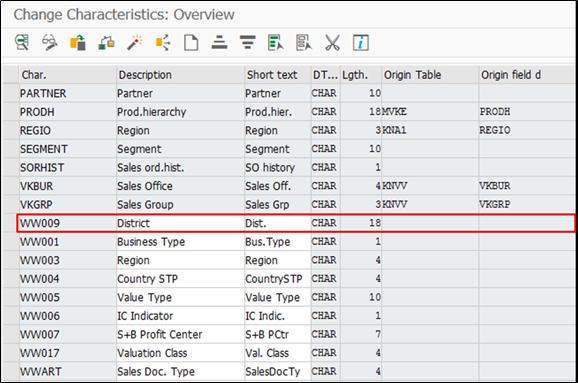

Following screen shows available and created CO-PA Characteristics in the system.

The characteristic region is not readily available, so we need to create it.

Click on

Then click on

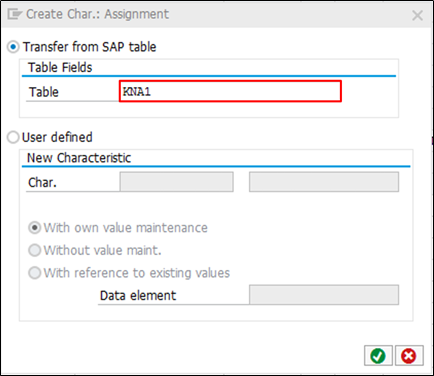

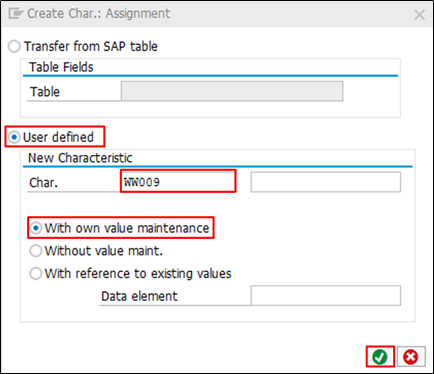

(Note: We have two options while creating defining characteristics, one is to transfer it from existing SAP table or second is to create user defined characteristics, which will have it’s own SAP table to maintain values)

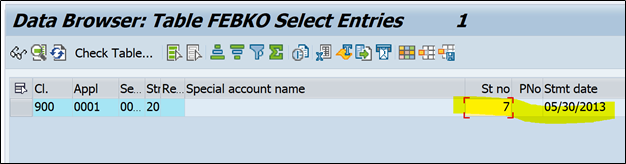

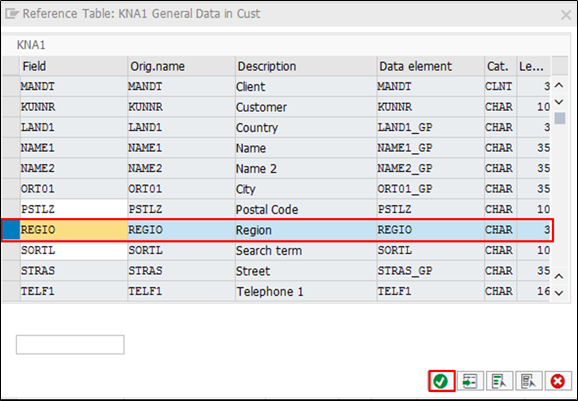

We are copying region characteristic from table KNA1

Here you can see the field region is added.

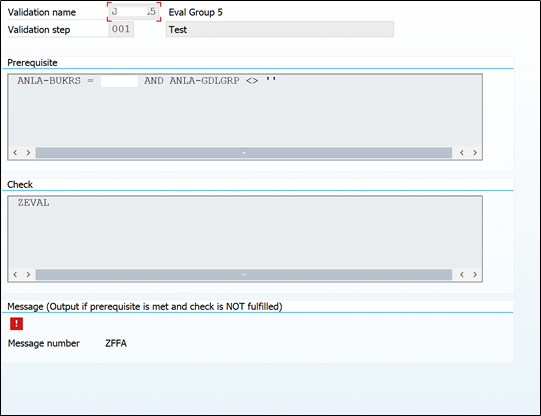

Now we will create a user define characteristics.

Note: A user defined characteristics should begin with WW.

Inputs:

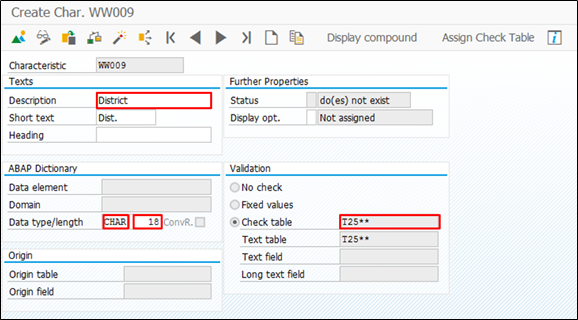

Description: District (we are creating district characteristic)

Data type: Character

Length: 18

Check table: T25** (here system will create table which starts from T25 and the values of this characteristics stored there)

We have created this characteristic from scratch (without any reference), so we need to update it manually at the time of posting.

Click on

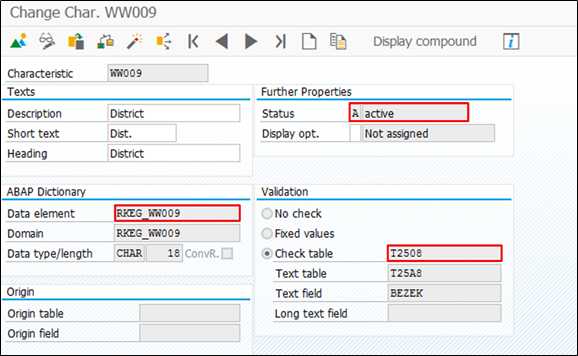

After activating characteristics you can see the status of characteristic and generated table.

Characteristic district is created.

Conclusion

In this blogpost we learned why characteristics are needed and how to maintain it.

As said at the start of the blog this blogpost is from this eBook, so if you want to know more about Controlling profitability analysis then you can checkout the book.

If you want to get notified with new blogpost, then do subscribe below