Everything about FEBKO & FEBEP Table (Part 2)

This is second part of this blog series. (Read first blog here – FEBKO details)

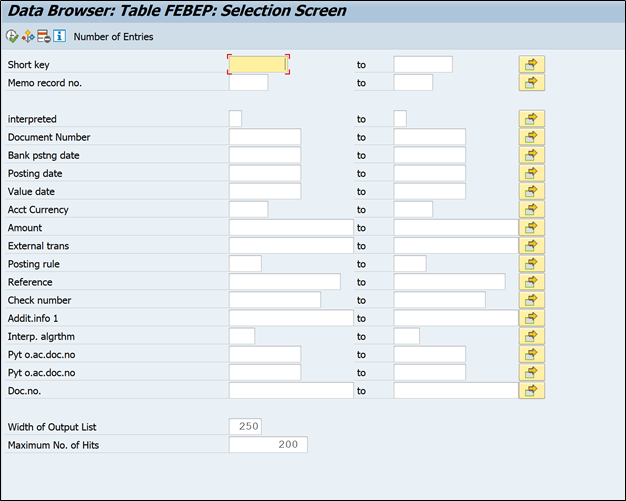

In continuation with previous blog, we will start this one with FEBEP table.

Introduction

FEBEP table stores line item records of bank statements. FEBKO & FEBEP table can be compared with BKPF & BSEG table, earlier one stores header information and latter one stores line item information.

If you check FEBEP Table fields, you can notice it is hard to directly look into FEBEP table without referencing FEBKO table. So you should always start your search from FEBKO table, where you have various key fields to narrow down your result data as per the requirement. Once you got the relevant entries in FEBKO which you need to further dig into line item level, then you can take the common field ‘short key – KUKEY’ and search for it in FEBEP table.

Lets execute one record and start checking FEBEP table field

First field is short key, unique key for each statement and common field between FEBKO & FEBEP

Then we can see LC field i.e. line item completed. It will show if the posting of this particular line is completed or not.

So in FEBEP table there will separate line for each transaction of bank statement.

U1 & U2 field represents posting area 1 & 2 postings. If the line item is associated with posting rule, which has accounting entry in two areas, then system will check if both areas are posted or not. This can be verified by x mark in U1 & U2 field.

Document number & posting date is document posted in SAP against statement transaction.

Read Blogpost: Tips and tricks on Bank Reconciliation in SAP

Further we have fields like account currency, amount of transaction. BTC – Business transaction code is used to determine posting rule based on the mapping in OT83. So here in FEBEP, system will capture the BTC (VORGC) from bank statement and search in OT83 if there is any external transaction code available of same character, if it is available then system will put it into FEBEP external transaction field (VGEXT). Posting rule (VGINT) will be determined from external transaction code.

There are several fields for partner bank details. These will be populated in case of clearing open vendor invoice.

Then there are various BDC fields available, which are supported by search string. If you remember there are various options available in search string setup to manipulate the final posting.

Then there will be fields like interpretation algorithm, it will have interpretation algorithm number which is used to post this line.

This all field data will make sense if you know the underlying configuration and how it evolve in each process. If you want to learn search string configuration, interpretation algorithm & posting rules with multiple posting areas, then you can read this ebook.

With this we have come to an end of this two part series blogpost. Hope you enjoyed reading it and learned few things. You can subscribe below to receive email update of every new blogpost: