Configure Depreciation area for foreign group currency in SAP

If group currency is different than company code currency then a separate depreciation area is required to be created under chart of depreciation.

The parallel currencies can be checked in OB22 transaction. If a company code using group currency as parallel currency which differs from the company code currency then we should create a separate depreciation area.

Until and unless we have a dedicated area for group currency valuation system will not allow us to assign chart of depreciation to company code.

So in order to configure additional depreciation area below steps needs to be followed:

Define depreciation areas

Path: SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Depreciation Areas – Define Depreciation Areas

While defining new depreciation area, always remember to copy it from book depreciation or the depreciation area from which the values will be taken over to group currency dep area.

It should not post to GL.

Specify Area Type

Transaction code: OADC

Path: SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Depreciation Areas – Define Depreciation Areas

On the same path double click on second row – Specify area type

On this screen one has to the depreciation area type from below available options. For group depreciation area it is necessary to select 06 group valuation area type.

Get eBook: What has been changed in New Asset Accounting

| 01 | Valuation for trade bal. sheet |

| 02 | Special dep. reserves (special tax depreciation) |

| 03 | Valuation for tax bal. sheet (diff. from trade bal. sheet) |

| 04 | Net worth valuation |

| 05 | Insurance valuation |

| 06 | Group valuation |

| 07 | Cost-acc. valuation |

| 08 | Investment support |

| 09 | Manual Revaluation |

| 10 | US: Federal tax ACRS / MACRS |

| 11 | US: SMACRS – State modified MACRS |

| 12 | US: ALTMIN – Alternative minimum tax |

| 13 | US: ACE – Adjusted Current Earnings |

| 14 | US: E&P – Earnings & Profits |

| 15 | Austria: investment incentive |

| 16 | Stock indicator for real estate management of insurances |

| 17 | Depreciation area for handling inflation (hard currency) |

| 18 | Balance sheet according to other guidelines (e.g. IAS) |

| 19 | Property Tax (Russia) |

| 20 | Transport Tax (Russia) |

| 21 | Area Posts Net Book Value for Retirement |

Specify Transfer of APC Values

Transaction code: OABC

Path: SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Depreciation Areas – Specify Transfer of APC Values

This node will decide from which depreciation area APC (Acquisition and Production cost) values will be taken over for group currency area.

Specify Transfer of Depreciation Terms

Transaction code: OABD

Path: SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Depreciation Areas – Specify Transfer of Depreciation Terms

This screen will decide the takeover of depreciation terms from which area to which area.

Identical tick mark will make sure values cannot be entered manually and should always be taken over from area 01

Define Depreciation Area for foreign Currency

Path: SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Currencies – Define Depreciation Areas for Foreign Currencies

In this config we will assign the currencies to depreciation area in which it should be posted.

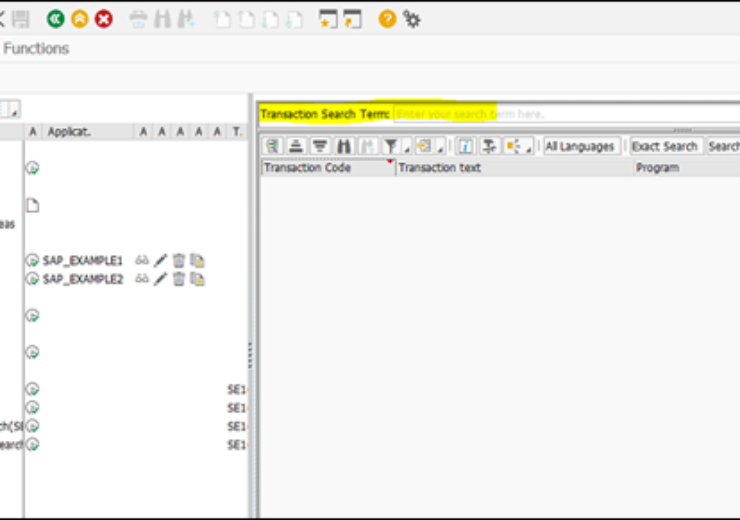

Specify the Use of Parallel Currencies

Path – SPRO – Financial Accounting (New) – Asset Accounting – Valuation – Currencies – Specify the Use of Parallel Currencies

Select the group currency for group valuation area.

Now system should allow us to assign chart of depreciation to company code

Assign Chart of Depreciation to Company Code

Path: SPRO – Asset Accounting – Asset Accounting (Lean Implementation) – Organizational Structures – Assign Chart of Depreciation to Company Code

Free eBook: End-User Manual – Asset Accounting in S4