Everything about FEBKO & FEBEP tables in SAP (Electronic & Manual Bank reconciliation)

Basics

These two tables comprises 70% of bank reconciliation. FEBKO & FEBEP are very close to those who are working in Bank Management area. Even though it is very important tables still many don’t know much about these tables. So in this blogpost we will be covering, what is the use of FEBKO & FEBEP table? What are the major key fields in FEBKO & FEBEP tables? How to get most out of these tables?

What is FEBKO & FEBEP table?

First lets understand the basic process of bank reconciliation in SAP. (Few can skip three paragraphs below if you already know about reconciliation process)

So there are two books of accounts involved in this process, one is of internal organization ledger maintained by organization and other is bank ledger maintained by bank. Two different parties trying to maintain same set of information in two different places. Whenever such situation happens, reconciliation jumps in. (this is something to be solved by blockchain technology).

User makes payment in SAP and book journal entry in Bank GL account (this is assumption). Same payment details send to bank (nowadays mostly electronically) via DME in SAP. Banks make the payment and book entry in their own ledger (this is actual). But sometime bank fail to make payment and don’t make any entry in their ledger, sometime bank make additional entries into their accounts for interest & charges (all are actual entries impacting your bank balance). But your SAP system don’t know about these transactions yet and so does the mismatch comes. And the reconciliation is required to match these two sets of books of accounts.

In SAP there are two ways (technically) to reconcile the balances. One is manually entering statement entries into system and reconciling through FF67. And other way is just uploading electronic bank statement in system through FF.5

If you want to learn entire process and configuration of manual & electronic bank reconciliation then you can read this ebook.

Now come back to our heading, what is FEBKO & FEBEP?

Before exploring these tables one should know that, Bank management is submodule of SAP FI, just like AA, AP, AR & GL. Hence just like in asset accounting, there are separate set of tables for asset accounting data and separate tables for storing accounting postings in GL area, in bank management also FEBKO & FEBEP tables are part of bank management and it does not store any accounting related data.

When you will run bank reconciliation transaction whether it is FF67 or FF.5, it will create some entries in FEBKO & FEBEP tables. Later on end user/ supervisor will check the bank statement data and post it to accounting (FEBAN process). At this stage accounting document tables BKPF & BSEG will be updated. Along with FEBKO & FEBEP with accounting document number.

FEBKO – Electronic Bank Statement Header Records

FEBEP – Electronic Bank Statement Line Items

As the description suggest FEBKO stores header records, it means for each bank reconciliation run in combination with house bank and account id FEBKO will have one line record generated.

FEBEP will have all the line items that are there in bank statements.

Fields of FEBKO table

FEBKO stores header records of bank statements in almost 109 fields. Obliviously we will not look into each and every, but we will see those which are important to know.

Whenever you will post bank statement via FF67 / FF.5 it will create one row in FEBKO table and multiple rows in FEBEP table depending on statement line records.

Now let’s see what information is available in FEBKO table:

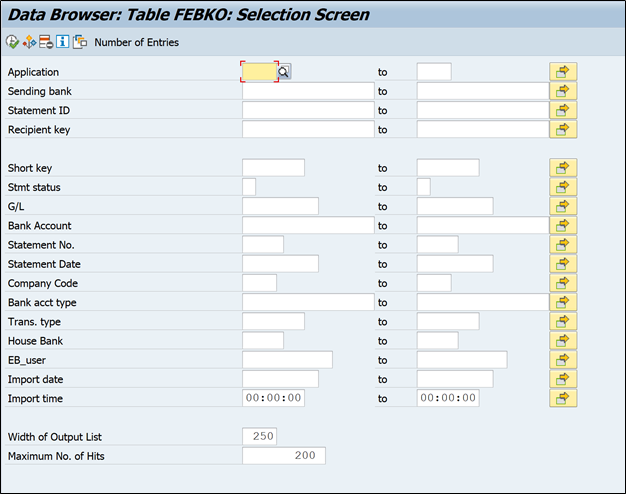

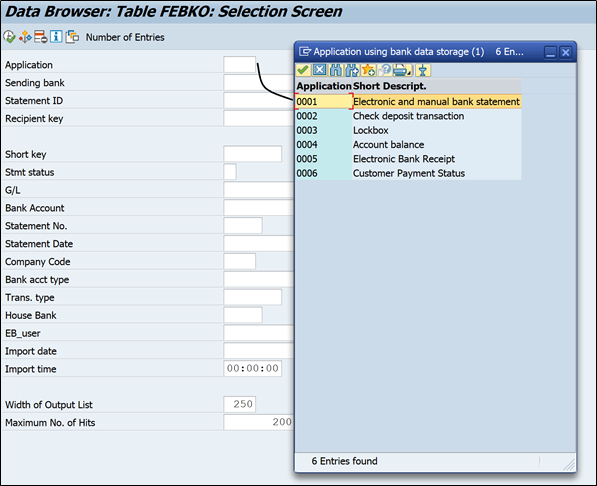

Application field – It helps to filter records based on its application. You can see 0001 is for bank reconciliation. Similarly 0004 is used for account balance records (bank send these records as part of intra day statement). Lockbox & check deposit transactions can also be seen based on usage.

Sending bank will have account number and currency combination.

Statement ID is internally assigned unique statement number to each bank statement.

Next important field is short key, it is unique key assigned to each record of FEBKO irrespective of application. This field is used across tables and programs to identify unique statement record.

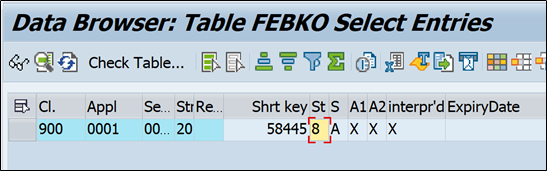

Let’s check one record:

In FEBKO –

In above screenshot you can see application number is 0001 so it is bank reconciliation entry. In sending bank field there is bank account number and currency (but we also have dedicated fields for account number and currency). In statement ID internal statement number is assigned. Short key is the unique number against this record, which you can use in any other tables/programs to find out this statement record.

Short key field is also a link between FEBKO & FEBEP table.

There is one program RFEBKA96 to delete bank statements from Bank management module (delete data from FEBKO, FEBEP.. etc)

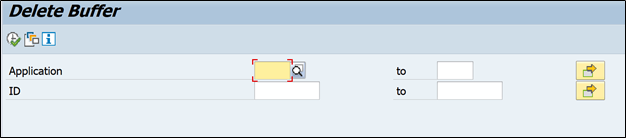

If you execute this program in SE38:

You can see it is asking for two values one is application, 0001 for bank recon statements, 0004 for account balance statements

And other field is ID, it is nothing but short key.

So let me execute this program with above statement (application 0001 & ID 205978)

And here we go, got exact statement with statement id. now lets delete it from here.

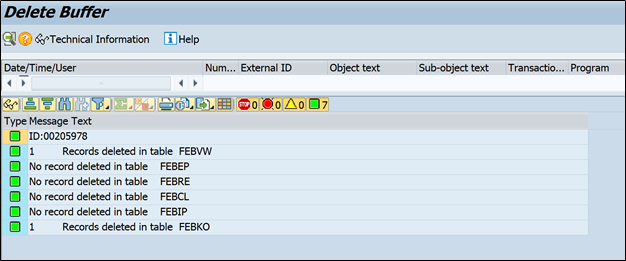

It will show you how many tables data is deleted with this activity.

And you can notice all are bank related table, so this statement is disappeared from bank managent system but if this statement has posted any accounting document it will be still there. That will need manual reversal.

So mostly this is used when no accounting document is posted and you want to upload new statement.

Now coming back to FEBKO table fields

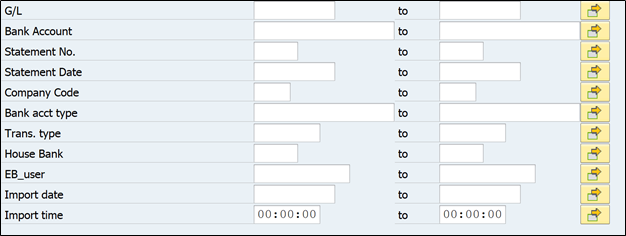

You can notice above there are several fields to filter out the statement records.

G/L – Of main bank account

Bank account – Bank account number

Statement no. – Bank statement number

House bank, Statement import date

Read eBook: SAP DME – A Simplified Guide

There is one more field that one should pay attention to and i.e. statement status (ASTAT)

This field will contain below values and by looking at it, you will be able to understand what is the posting status of this bank statement.

0 – Being entered

1 – Being post edited

2 – Entered =20

3 – Post edited=20

4 – Being posted

5 – Delete ID reset

7 – Posting incomplete

8 – Posting complete

9 – Deletion ID set

Whenever status will be 8 it means bank statement is fully posted without any error, Similarly 0 means statement is uploaded by selecting – ‘Do not post’ option. 7 – posting incomplete will tell that some of line items are not posted to accounting yet.

Next to statement status there are two fields A1 (Area 1) & A2 (Area 2). While defining posting rules you have option to define two accounting entries in two areas. It is used for clearing customer/vendor open line item along with incoming/outgoing bank GL line item. These fields will represent that two accounting entries, if marked with X means both entries are posted without any error.

(the above scenario is explained in more detail in this ebook)

Read Blog: Everything about derivation rule in SAP COPA

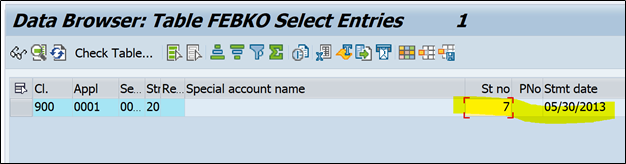

Field – statement number & statement date

These fields are populated from bank statement.

Statement number represents unique statement received for that specific bank account number. System also do not allow duplicate statement number for same bank account number.

Statement date is also taken from bank statement. It also represent the date on which transactions took place.

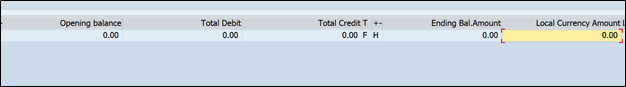

As we discussed FEBKO is header level table, so it also display the total debit & credit posting of statement and along with opening and closing balance.

These are all important field of FEBKO table, it helps a lot if you know what is the use of these fields & from where it is updated.

Next in FEBEP table we will see information about accounting documents, posting rules, interpretation algorithm

Fields of FEBEP table

This we will see in 2nd part of this blogpost.

Hope you enjoyed reading the post. You can subscribe to our newsletter to get update of new blogpost.

you can stay connected with us on below platforms: