SAP New Asset Accounting in S4HANA – Transaction type

First let’s discuss transaction type in ECC.

What is the use of transaction types in Asset Accounting?

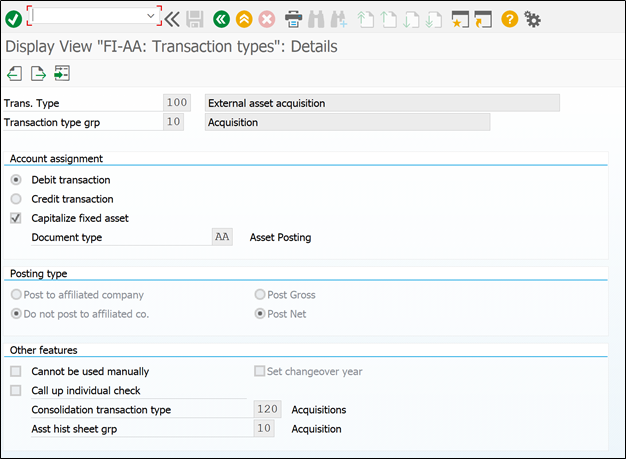

On high level, we can say that transaction types in Asset Accounting are used to differentiate business transactions like acquisitions, retirements etc. if we see the configuration screen of transaction type, one can notice that it controls Debit/Credit posting of asset, document type, asset history sheet group etc.

Transaction type configuration Tcodes

- AO76

- AO75

- AO74

- AO73

Apart from this, there is one more important function of transaction type in ECC, i.e. to restrict postings to specific depreciation area.

How to restrict transaction type to depreciation area?

To use this feature companies, have to configure thousands of transaction types.

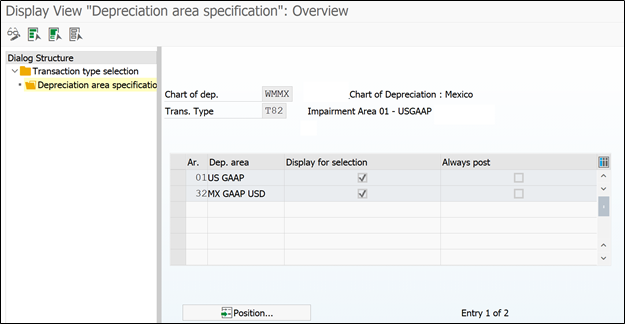

Transaction code OAYA to restrict transaction type to specific depreciation area:

Let’s spend few seconds to understand why it is important to restrict some of the postings to specific depreciation area.

You know that, we assign leading and non-leading ledgers to depreciation areas. And accordingly depreciation areas post to that leader. Further ledger represents the valuation area e.g. Local Valuation, US GAAP valuation, Group Valuation. In many instances, user has to post specific entries in specific valuation area. In those cases, depreciation area leads the way by using correct transaction type.

In ECC Asset Accounting there is not dedicated transactions that allows to post documents ledger wise. So the transaction key plays the vital role in posting documents to appropriate ledgers.

Transaction type determines depreciation area to be posted and depreciation area determines ledger to be posted.

Also Read: Note to Payee Functionality in SAP DME

This is cool to know the structure, but multiple countries have multiple chart of accounts, which further have many depreciation areas and this leads to creation of many transaction types depending of the geographical size of organization.

This problem has been solved in S4HANA.

Asset Accounting Transaction Types in S4HANA

In new Asset Accounting, it is not possible and also not necessary to restrict transaction types to depreciation areas. This is not necessary since, in end user transaction codes itself SAP has provided option to restrict the posting to depreciation area or accounting principle level. This means you have option to select the depreciation areas to be posted while posting document.

This change has significantly reduced the number of transaction types that need to be defined in the system along with the time consultant has to spend configuring these transaction types.

Let’s see some end transaction codes in Asset Accounting:

Transaction code ABAON

You can notice in above screenshot the highlighted area shows the option of manually entering Accounting principle (Ledger) and Depreciation area.

So no need to stay dependent on transaction type. Accounting principle itself determines ledger to be posted.

Read eBook: Manual and electronic bank reconciliation in SAP

Conclusion

In S4HANA transaction type is still relevant for its configuration control of AO7* setup. But the dependency to post ledger specific documents is being reduced. This become possible because S4HANA has option to have multiple leading depreciation area at a time and all depreciation area can post real-time.

If you want to know more about changes in S4 compared to ECC, you can give try to this eBook.

Also enjoy this free eBook – End user manual for New Asset Accounting.

This brings us to end of the blogpost. Hope you enjoyed reading it. You can subscribe below to get email of new blogpost. Also you can connect with us on below platform.

If you enjoy the blogpost, then you can Subscribe to our newsletter and receive email notification for new blogpost, also stay connected with us on below platforms:

This is available in ECC too, it’s not just limited to S/4HANA. You just have to implement the new parallel valuation solution for ECC and then the functionality is nearly identical (as it relates to this topic).