Everything about General Ledger account – Part 2

This is the second blog of the series read the first blog here.

Everything about General Ledger account – Part 1

We have already discussed about G/L accounts and pre-requisites to create it in first blog

In this second part of the blog, we will discuss about types of chart of accounts and their uses, fields in G/L account, and the importance of each field.

Let’s start with the type of chart of accounts -> almost everyone knows there are three types of Chart of Accounts, but that’s not enough to use them wisely, that’s why we will have more deeper look into it.

- Global Chart of Account

- Group Chart of Account

- Country specific Chart of Account

The interesting part is all of the Chart of Account is created in transaction code OB13, then how one becomes Global COA and other Country specific COA -> it is decided on their assignment.

Let’s check with example:

Suppose I have created two Chart of Account in OB13 -> 1. COAG 2. COAC

In the COAG chart of account I have assigned the COAC chart of account in the field group chart of account, then COAC will become group chart of account and COAG will be global chart of account.

Similarly, if the Chart of Account is assigned in the transaction code OB62 as a country chart of account then it will become a country-specific chart of account.

Global chart of account is considered as an operating chart of account, various reports can be only run on this Chart of Account or with the G/L accounts created under Global Chart of Accounts. So it makes other COA less valuable. But still, in the companies which are spread internationally, country-specific chart of account used widely.

We can group the G/L accounts in Country spec. G/L accounts by assigning same G/L account to many operating G/Ls.

What is the need of Country specific G/L account?

In some countries, there is a legal requirement to prepare financial statements using specific G/L codes. In order to map this requirement SAP has provided the functionality of Country spec. chart of account.

When the country chart of account is assigned to Company code, then it becomes mandatory to assign every G/L account to the alternative G/L account.

Fields in G/L accounts and their use:

G/L is divided into the two parts, Chart of accounts and company code. In hierarchy chart of account is above company code. It is because fields or tabs available in the chart of account level, impacts all the company codes to which chart of account is assigned. In contrast company code level changes only impacts for that specific company code.

We will start with the first tab of G/L account. (as the below information may be too much common, you can skip the below parts of the blog and directly jump to the part which you want to know)

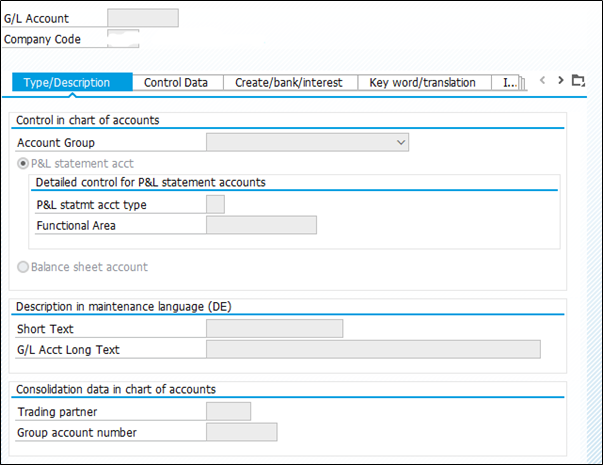

The first tab Type/Description of G/L account is under chart of account, all the fields in this tab will be changed or modified for a chart of account.

Account Group: As we know, SAP only divides G/L account in the P&L account and Balance sheet account, but the G/L account should be grouped in deeper criteria.

P&L statement Account type: In order to explain the use of this field, we have to explore the concept of Retained earning Account in SAP

As we all know retained earnings of the current year are taken from the profit and loss statement and transferred to the balance sheet liability side. We can also call it net profit as an alternative.

How to set retain earing account?

Create a balance sheet G/L account and assign it in OB53 transaction with one representative symbol like X or Y

Now if you define two retain earning in customising for same chart of account then this option of P&L statement account type will be available for selection of retained earning account. (otherwise system will take retained earning account by default)

It is assigned to each and every P&L account. At the year-end balance of P&L accounts carried forward to the next year with retained earning account. Every account balance is cumulated in this account and then the net sum of debit and credit balance in retained earning account is transferred to the balance sheet.

Description: Name of the G/L account, the language of the description is considered as the language of chart of account maintenance.

Group chart of account: If the group chart of account is assigned to the Operational chart of account then this field becomes mandatory to fill. The G/L accounts created in the Group chart of accounts are available for selection in this field.

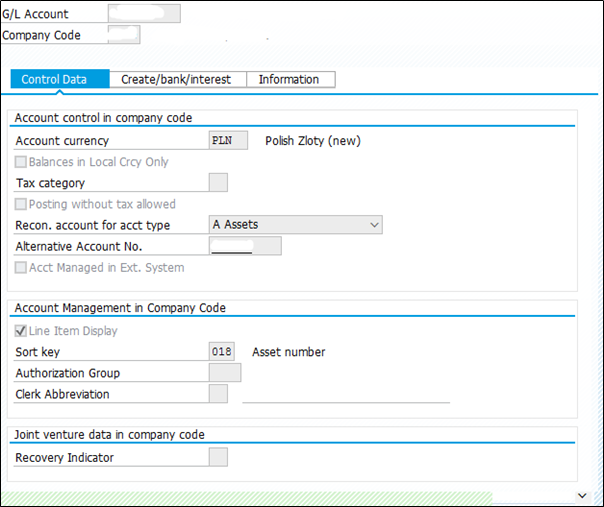

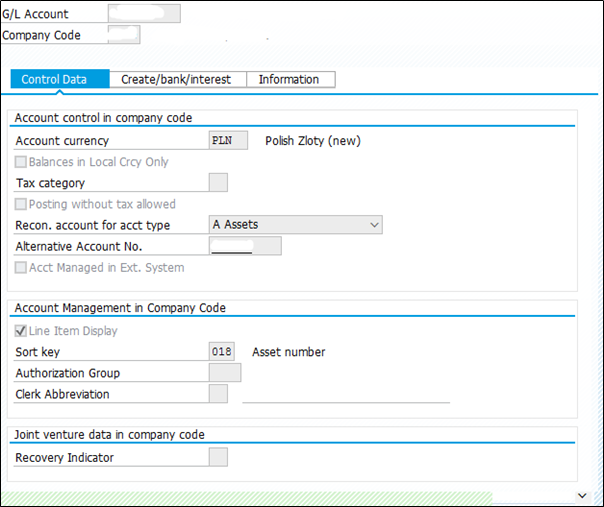

Control Data

This tab comes under company code level, hence all the changes done in this tab will affect only the relevant company code

Account Currency: If a currency other than the company code currency is specified, users can only post items in that currency to this account. If the company code currency is specified, users can post items in any currency to this account.

Tax Category: With this you can restrict the G/L accounts to be posted with wrong tax, you can specify if only output tax or input tax should be posted on the G/L account or all types of tax is allowed, if kept blank, the system will now allow to post the G/L account with tax.

Recon. Account for account type: (SAP text is enough to understand this)

An entry in this field characterizes the G/L account as a reconciliation account. The reconciliation account ensures the integration of a sub-ledger account into the general ledger.

E.g. G/L account 140000 is defined as a reconciliation account. In the customer account 4711, the G/L account 140000 is determined as a reconciliation account. In this way, all postings to customer account 4711 are also posted automatically to the G/L account 140000. The G/L account itself is not designed for direct posting. In this way, reconciliation between sub-ledger and general ledger is always guaranteed.

Alternative Account Number: The alternative account number field in the company code area is freely definable. You could use it to enter:

- The account number from your legacy system or

- The account number from a country chart of accounts if your corporate group uses a standard chart of accounts.

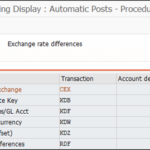

Exchange rate difference key: to determine G/L accounts to post valuation gain or loss. Instead of maintaining each G/L account with gain/loss accounts in customizing, you can create keys and assign them to multiple G/L accounts in the master data level.

Create/Bank/Interest

This tab also correspond to the company code

Field status group: this is for the transactional data, which field should be mandatory/optional/suppressed while posting to this G/L account is determined here.

Reconciliation account ready for input: indicator which determines that the reconciliation account is ready for input when posting a document. The indicator is used in Financial Assets Management like when you make an initial load of the asset balances the balances are being posted to Asset Sub-Ledger but not to the GL Account.

Hence, in such cases, you are required to Reset the Reconciliation Accounts in OAMK and post the same entries into GL Account that you have loaded to Asset Sub-Ledger and then again make them as Reconciliation Accounts.

Note: On the other hand Reconciliation Accounts are only mean for posting by the System, but when you select the “Recon. account ready for input”, it would become like a normal account, it will allow you to post directly, this would invalidate the integrity of the data. Therefore, you should never put the checkbox Reconciliation Account ready for input for RECONCILIATION accounts.

House Bank & account ID: to determine the bank master data or bank account

Key word/translation:

Keyword helps to search the G/L account in F4 help

Translation is make description of G/L available in multiple logon languages.

Chart of account information

This tab contains the information of created and changes made to the COA level

Company Code information

This tab contains the information of created and changes made to the company code level

Okay… And this brings us to the end of this blog.

If you have any suggestions or questions do let us know in the comment section or you can also write us directly.

Sign up with us to get an update of a new blog post. Till then you can have look at our ebooks.

Comment (01)